5 Money Lessons

Money lessons are not about earning more but about managing what you already earn wisely. With the right habits, anyone can save consistently and build wealth over time. In this blog, we’ll explore 5 practical money lessons that show how small savings, smart UPI use, avoiding hidden expenses, and investing early can completely transform your finances in 2025.

Lesson 1: The 1 Rupee Lesson

Can just ₹1 a day make a difference? Absolutely!

If you save only ₹1 daily and keep increasing it over the years, it compounds into lakhs over time. The real secret isn’t the amount—it’s consistency.

Think about it. If ₹1 has potential, imagine saving ₹100 daily. That’s how small changes turn into life-changing results.

Lesson 2: Wrong Money Beliefs to Avoid

One of the biggest money myths is that higher income automatically equals higher savings. The truth? As income increases, expenses rise too—this is called lifestyle inflation. That’s why savings don’t happen automatically. Savings must be planned first, before you spend. The simple rule: Pay yourself first, then spend the rest. 👉 Read also: 5 Smart Money Habits to Save ₹10,000 Every Month

Lesson 3: Smart UPI Hack

UPI makes spending super easy, but it can also encourage overspending. A simple hack is to create a separate wallet or bank account only for daily expenses. Add your spending budget there and use only that for payments. This keeps your main savings account untouched and safe. Try it once—you’ll notice a big difference in your monthly balance.

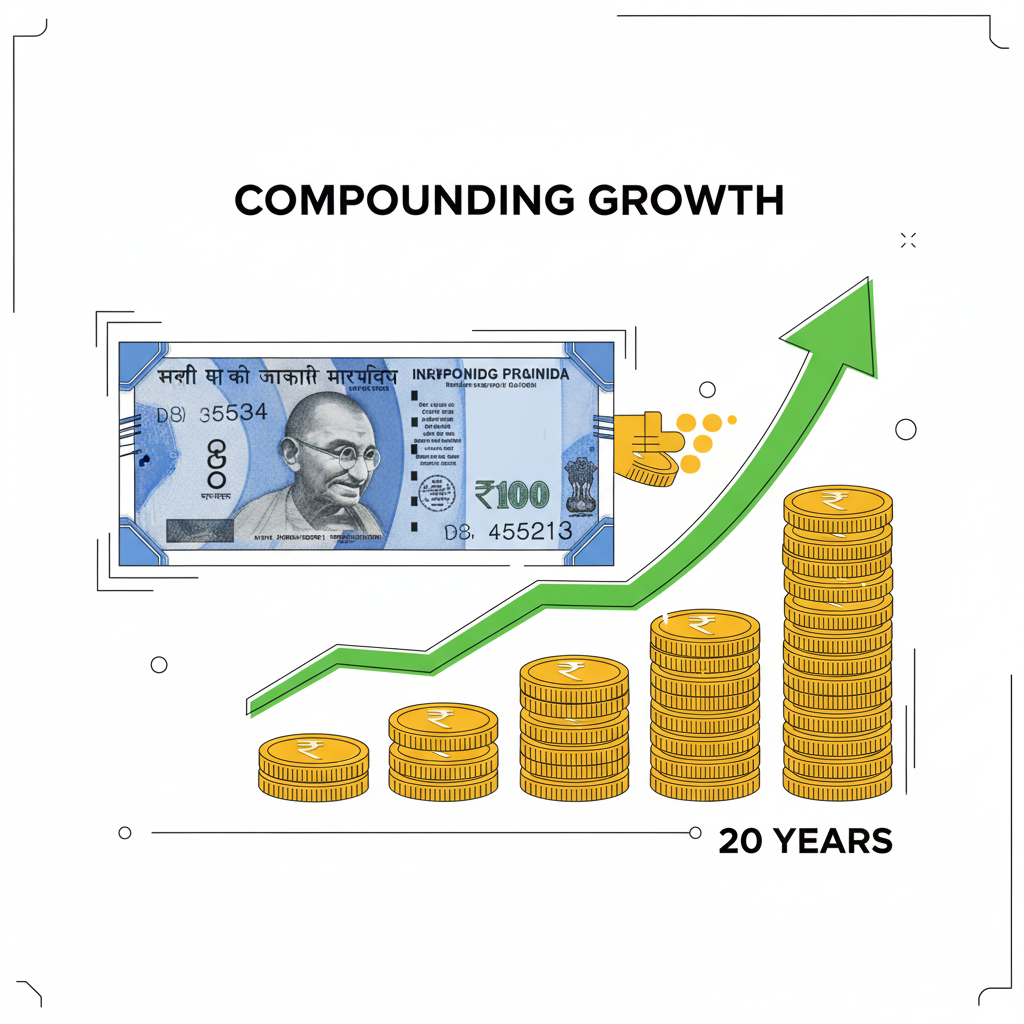

Lesson 4: The Future Value Trick

What’s the value of ₹100 today vs in the future? If you spend it on tea and snacks, it’s gone forever. But if you invest ₹100 daily in a mutual fund SIP at 12%, in 20 years it grows into over ₹30 lakh! This lesson shows why investing early matters more than waiting for a “big amount.” Time and compounding are your best financial friends. Helpful resource: Investopedia – Saving Money Tips

Lesson 5: Hidden Expense Trap

Your biggest expenses may not be EMI or rent.

It’s often small daily spends—like ₹30 coffee, ₹50 snacks, or ₹200 cabs—that secretly add up to ₹5,000–₹10,000 monthly.

The best way to fight this trap is to track and review these tiny spends. Apps like Walnut or Money Manager help you see where money leaks and plug the gaps.

Conclusion

These 5 simple money lessons prove you don’t need to be rich to start building wealth.

Start with small savings, cut hidden expenses, use UPI smartly, and invest early. Over time, these habits can completely transform your financial journey in 2025 .”

1. Do I need a high income to start saving?

No. Even small savings grow over time with discipline and consistency.

Q2. How can I stop overspending with UPI?

Create a separate wallet or account only for spending. This way, your main account remains safe.

Q3. What is the best way to invest ₹100 daily?

Consider SIPs in mutual funds with long-term growth potential. (Always consult a financial advisor.)

Q4. How do I track hidden expenses?

Use free apps like Walnut or Money Manager to monitor daily spending patterns.

Q5. Is it too late to start saving in my 30s or 40s?

Not at all. The best time to start

was yesterday. The second-best time is today.

Pingback: Become Debt-Free Fast: 8 Proven Steps for Financial Freedom