💬 Introduction: The Retirement Puzzle

NPS vs UPS — Which Pension Plan Secures Your Future in 2025? NPS vs UPS is one of the most searched comparisons among retirement planners in India today. With multiple pension schemes like Old NPS, Guaranteed NPS, and the Unified Pension Scheme (UPS), it’s confusing to decide which one offers the best long-term security. In this blog, we’ll simplify the difference with real calculations, easy comparisons, and a practical verdict. Most people invest without knowing which pension plan actually secures their future. In 2025, three major retirement options exist — Old NPS, New Guaranteed NPS, and Unified Pension Scheme (UPS). Each has different rules, returns, and risk levels. Let’s decode them with real numbers and simple math.

🧮 1️⃣ Calculation Setup

Let’s assume: • Monthly contribution = ₹5,000 • Service period = 30 years • Old NPS return = 10% CAGR • Guaranteed NPS = 8% fixed • UPS = 50% of last salary • Final average salary = ₹60,000 compared side-by-side in an infographic style, with coins and calculator background.”

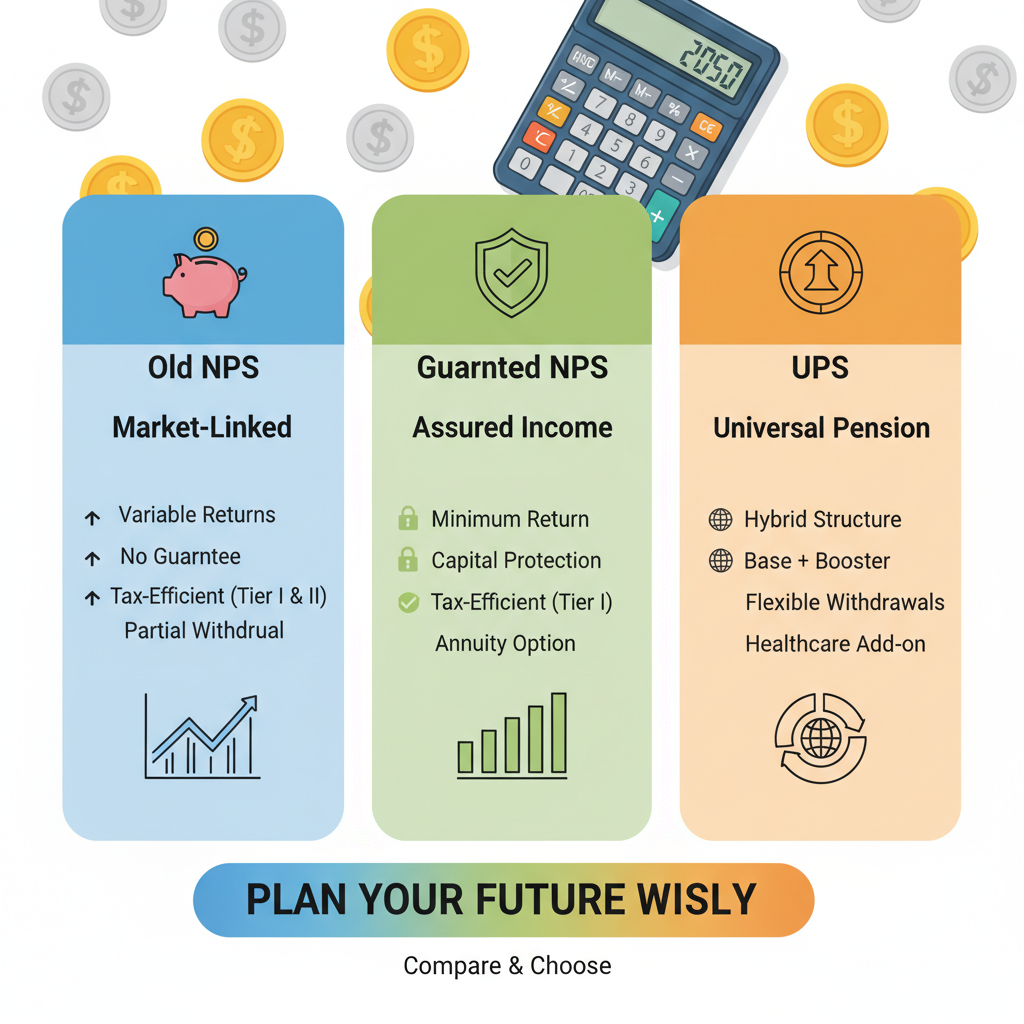

💹 2️⃣ Old NPS – Market-Linked Growth

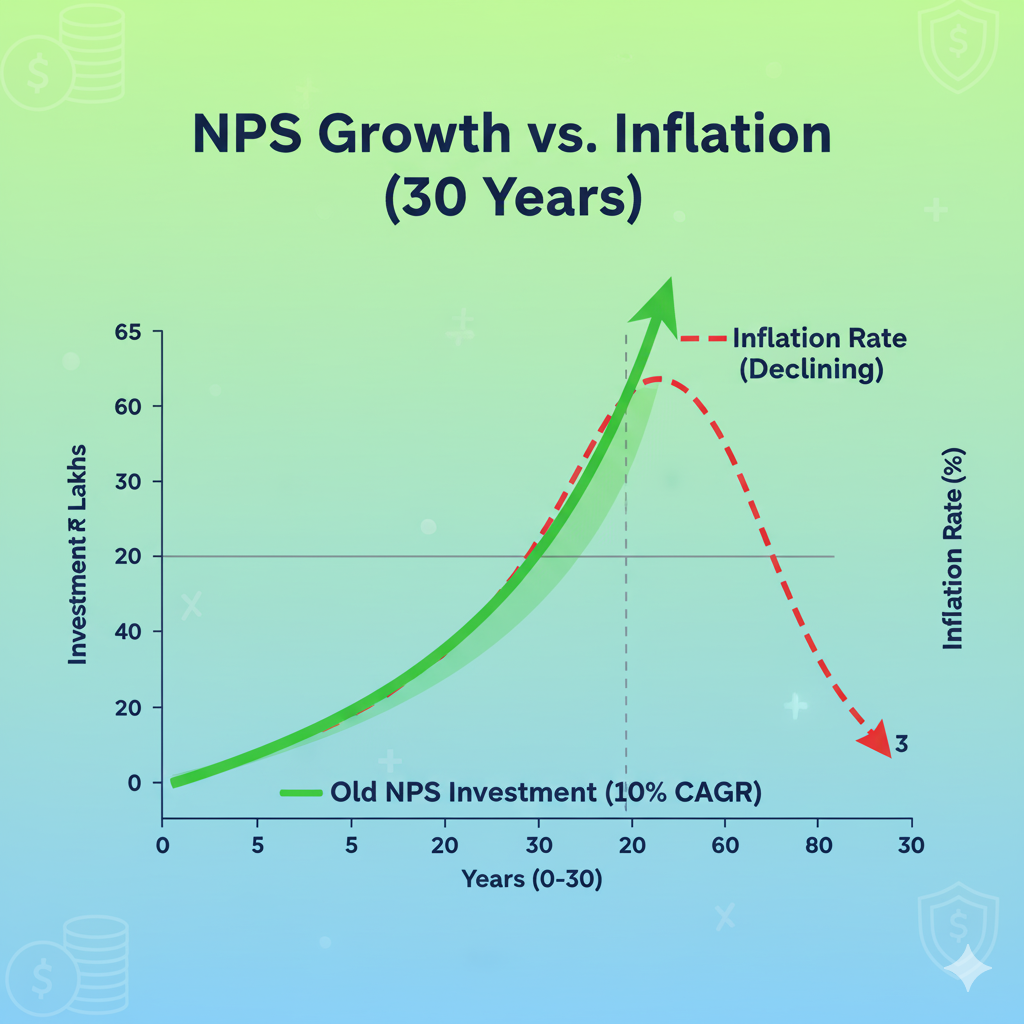

In Old NPS, ₹5,000/month for 30 years at 10% CAGR grows to ₹1.13 crore. 40% must go into an annuity, giving around ₹26,000/month pension. The remaining ₹68 lakh can be withdrawn tax-free. However, there’s no inflation protection — ₹26,000 today may feel like ₹10,000 after 20

💰 3️⃣ New Guaranteed NPS – Stable Yet Safe

Under the new model, investors get an assured 8% return with inflation-linked pension payouts. After 30 years, the corpus becomes ₹75 lakh — slightly lower but more predictable. 20% goes into annuity giving ₹10,000/month pension, adjustable with inflation. Remaining ₹60 lakh stays flexible — perfect for moderate investors seeking balance. This makes the New Guaranteed NPS a safer choice in the NPS vs UPS comparison.

🧓 4️⃣ UPS – Lifetime Security for Govt Employees

The Unified Pension Scheme (UPS) guarantees 50% of last salary after 25+ years of service. With ₹60,000/month final pay, you get ₹30,000/month lifelong pension, plus Dearness Relief (DR) to fight inflation. No market risk, no annuity purchase — complete peace of mind. However, it’s available only for government employees, so for private-sector workers, NPS vs UPS becomes a key decision point.

⚖️ 5️⃣ Side-by-Side Comparison Table

|

Feature |

Old NPS |

Guaranteed NPS |

UPS (Govt) |

|

Return Type |

Market-linked |

Fixed + Inflation |

Guaranteed Pension |

|

Avg Return |

~10% |

~8% |

Defined |

|

Final Corpus (30 yrs) |

₹1.13 Cr |

₹75 Lakh |

NA |

|

Monthly Pension |

₹26K |

₹10K + inflation |

₹30K + DR |

|

Liquidity |

60% |

80% |

None |

|

Risk |

High |

Low |

Nil |

|

Best For |

Aggressive |

Moderate |

Govt Staff |

🏁 6️⃣ Final Verdict

✅ Old NPS — Best for high-return seekers with long-term vision.

✅ Guaranteed NPS — Ideal for those wanting safety + inflation protection.

✅ UPS — Perfect for government staff who prefer stability over growth.

For most private employees, the New Guaranteed NPS offers the best mix of growth, safety, and inflation cover.

So in the NPS vs UPS battle, the winner depends on your risk appetite and career type.

💡 Pro Tip

Diversify your retirement planning:

Use NPS for tax savings, SIPs for growth, and insurance for stability.

That’s the smart formula for 2025 and beyond — and the best way to balance the NPS vs UPS equation.

Bonus Insight:

Before deciding between NPS vs UPS, always analyze your job type, income stability, and inflation rate. Many financial planners suggest combining Guaranteed NPS, mutual funds, SIPs, and even small savings schemes for a well-balanced, inflation-beating portfolio. This hybrid strategy offers both growth and long-term security, ensuring consistent wealth creation and a truly stress-free, financially independent retirement life in India for you and your family.