5 Smart Money Habits to Save ₹10,000 Every Month can transform your financial life. By following these simple money-saving tips, anyone can build wealth, achieve goals, and stay stress-free about money

1. Why Saving ₹10,000 Monthly Matters

Saving ₹10,000 every month may not sound like much, but in a year, it adds up to ₹1.2 lakh. If you invest that wisely, you can build long-term wealth. Developing strong smart money habits ensures you’re financially secure, prepared for emergencies, and on track toward your goals.

🎥 Watch the full video here and don’t forget to Subscribe for more finance tips:

👉 [YouTube Channel – @vikasonfinance](https://www.youtube.com/@vikasonfinance)

1. Track Every Expense

The first step to building smart money habits is knowing exactly where your money goes. For at least one month, write down every expense or use a tracking app. You’ll quickly notice unnecessary spending—like extra food deliveries, impulsive shopping, or unused subscriptions—that silently drain your savings. By tracking every rupee, you’ll develop the awareness needed to cut waste and build consistent savings.

2. Follow 50-30-20 Rule

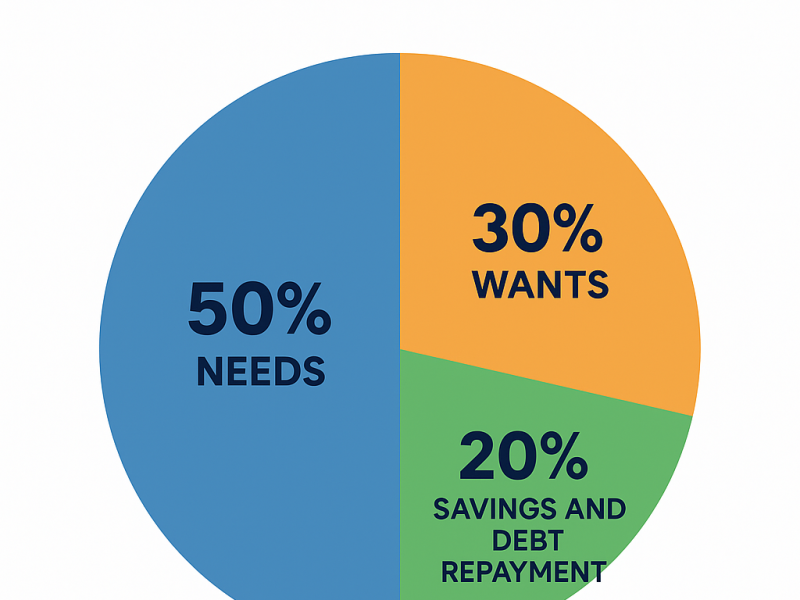

One of the smartest money habits is using the 50/30/20 rule to manage your income. Here’s how it works:

-

50% of your income → Needs (rent, groceries, utility bills)

-

30% → Wants (movies, dining, shopping)

-

20% → Savings and investments

By following this simple system, you’ll always have money allocated for savings and future growth while still enjoying life guilt-free.

✅ Why this wo

3. Cut Down Unnecessary Subscriptions

3. Cut Down Unnecessary Subscriptions

One of the most overlooked areas where people lose money is in unused subscriptions. From OTT platforms and gym memberships to paid apps and software trials, these small recurring charges silently eat into your income every month. Most people don’t even realize they’re paying for services they rarely, if ever, use.

Building smart money habits starts with reviewing these expenses. Take one hour to check your bank statements, UPI payments, or credit card auto-debits. List every subscription and ask yourself: Do I really use this often enough to justify the cost? If the answer is no, cancel it immediately.

For example, if you cancel just two streaming services costing ₹500 each, you instantly save ₹1,000 every month—or ₹12,000 in a year. That’s money that can be redirected toward investments, an emergency fund, or a financial goal.

This simple habit not only boosts your savings but also gives you more control over where your money flows—making it one of the easiest smart money habits to adopt today.

4. Automate Your Savings

Don’t wait until the end of the month to save what’s left. Instead, save first and spend later. Set up an automatic transfer of ₹10,000 from your salary account to a savings account or SIP. This creates discipline without effort and ensures your financial goals are always prioritized.

Remember: Treat savings like a bill that must be paid—non-negotiable and consistent. Over time, this small shift becomes one of the most powerful smart money habits, turning saving into a lifestyle rather than a choice.

5. Start Side Income

Relying only on one salary can limit your savings. Starting a side hustle can bring in extra income that you can save or invest. Options include:

Freelancing (writing, design, coding)

Online tutoring

Selling products on marketplaces

Affiliate marketing or blogging

Even an extra ₹5,000–₹10,000 per month can double your

Bonus Tips: How to Save ₹10,000 Per Month in India

Cook at home instead of eating out

Use cashback and discount apps

Cancel unused subscriptions

Buy in bulk for groceries

Set short-term goals (like saving for a trip) to stay motivated

✅ Conclusion – Start Your Savings Journey Today

Friends, ye 5 smart money habits simple hain but life-changing. Agar aap abhi se follow karna start karte ho, toh agle 12 months me easily ₹1,20,000 save kar sakte ho.

very informative and engaging